7

Disrupt or be disrupted

|

Defining our terms: survey

methodology

Leaders vs. laggards

Leaders:

Organizations in the top

third in bottom-line profitability

and new product introductions

during the previous 24-month

period.

Laggards:

Organizations in the

bottom third on those same

measures during the same

time period.

Advanced analytics:

Complex

predictive and prescriptive

analysis requiring data sets to

be combined and analyzed by

statisticians or data scientists

using sophisticated techniques

and specialized software

packages (e.g., SAS, SPSS or R);

dashboards, reporting and general

business analysis are not included

for the purpose of the survey.

Part 2:

Leaders vs. laggards across industries: what top

performers think, know and do

The survey methodology sought to provide a clear view of the approach and practices

of top-performing organizations across industries in terms of their use of new data and

emerging technologies.

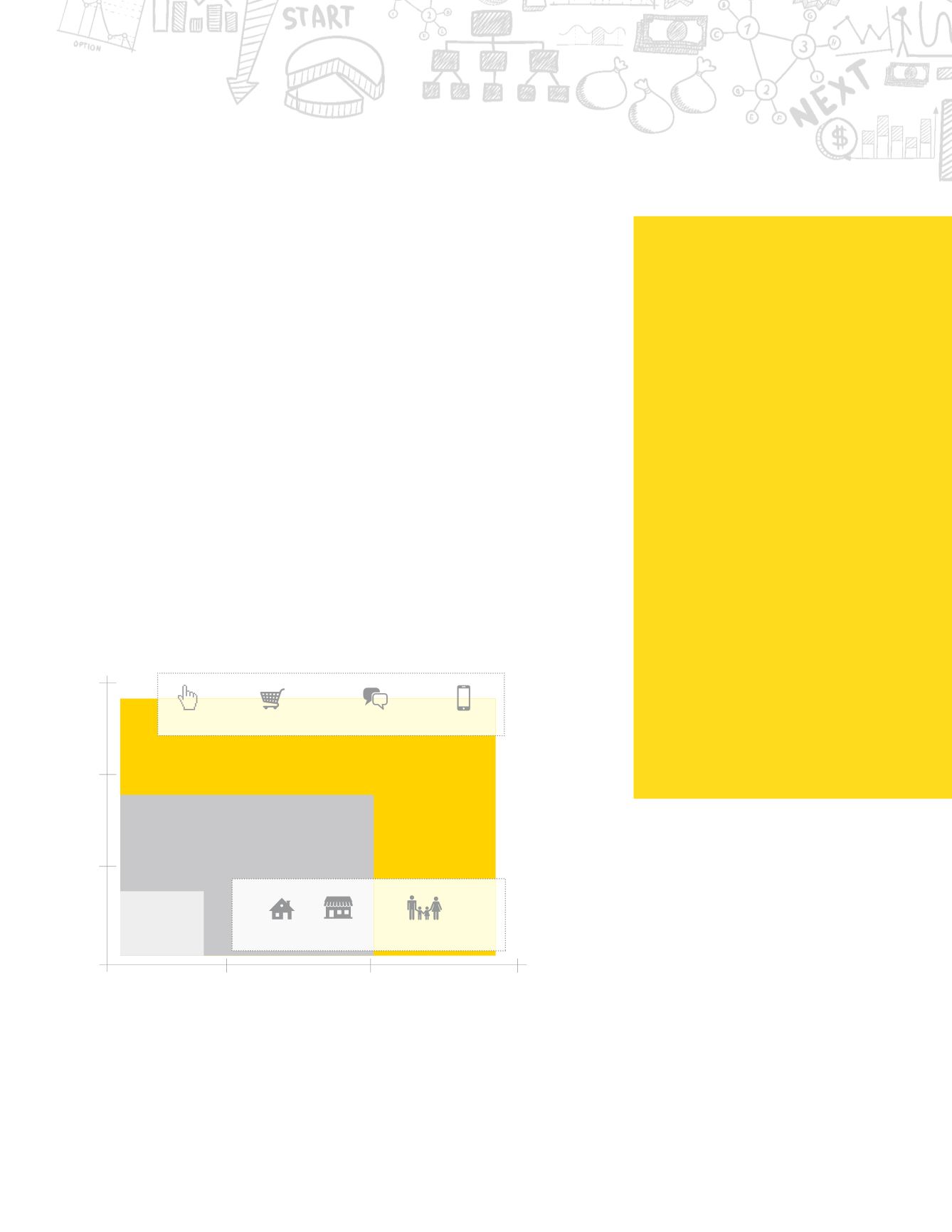

The clearest difference between leaders and laggards is that leaders are much better at

advanced analytics, thanks to a holistic and broad-based approach.

See Figure 4.

Qualitatively,

leaders have more of what they need to know about their customers when they need to know

it. Specifically, they have better insight into:

• Who their customers are: persistent facts about life/business stage, preferences,

demographics, and social and professional networks

• What they do and think: transactions and trackable interactions, plus a sense of values,

wants, needs and attitudes

• How they change: evolving circumstances and where they are headed

Looking deeper, leaders continually seek more context in terms of customer data and insights

by prioritizing the integration of external sources and enabling more business users, while

laggards optimize the status quo. What’s more, 75% of laggards are dissatisfied with their

company’s advanced analytics capabilities — meaning this is a status quo that is likely not

worth optimizing. On the other hand, leaders are quite satisfied with their advanced analytics

capabilities, though they clearly have a bias toward continuous improvement.

See Figures 5

and 6.

Figure 4:

Near/at best-in-class customer information

0%

25%

50%

75%

25%

50%

75%

Leaders

All respondents

Laggards

actions transactions behaviors channels

life/business stage demographics

Who customers are and how they’re changing

What customers do and their attitudes